Which token should I distribute yield in to my token holders?

My thoughts on token buybacks and distribution

A lot of DeFi protocols buyback their native token using the revenue they generate and distribute it proportionally, i.e., pro-rata to holders (i.e., lockers, stakers, or whatever mechanism the protocol uses).

While the end goal of these protocols remains the same (accrue value to the token directly or indirectly), the means by which this is done varies from protocol to protocol.

Some protocols like doing a buyback and burn, some protocols like the revenue to accrue in the treasury (which is then governed by token holders), and some, as mentioned above, like buying back the native token and distributing it to token holders.

This post won’t talk about the former two nor the “optimal” mechanism (as there is none and it depends on the protocol), but will examine the consequences of buying back the protocol’s native token and distributing it to token holders, and will examine which token should be used to distribute yield to token holders.

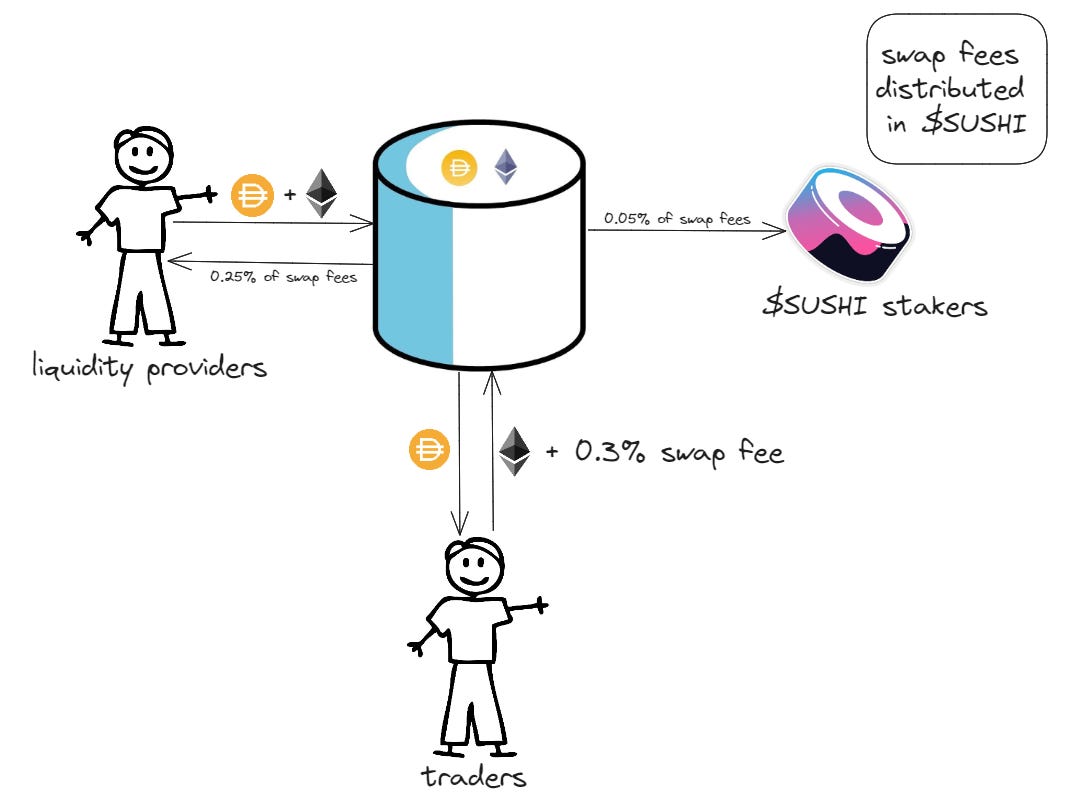

SushiSwap (a DEX) with its token, $SUSHI, works like the following:.

Traders swap tokens using liquidity hosted on the AMM and pay a 0.3% swap fee for doing so.

0.25% of the swap fee goes to the liquidity provider(s) facilitating these trades.

The remaining (0.05%) of the swap fee goes to $SUSHI stakers, i.e., $xSUSHI holders (you get $xSUSHI when you stake $SUSHI) by buying back $SUSHI and distributing it proportionately to the staker’s share of the staking pool (for example, if my $SUSHI stake constitutes 1% of the total stake in the pool, I get 1% of the $SUSHI bought back by the protocol).

So, essentially, this model 1) puts buy pressure on the $SUSHI token (as the protocol is buying it back with 0.05% of the swap fees) and 2) accrues value to $SUSHI stakers as a yield denominated in $SUSHI is shared with them, hence incentivizing users to take $SUSHI tokens off the market (buying them) and stake them.

So, we can logically deduce that (apart from speculation and auxiliary use cases of the $SUSHI token like governance), an increase in volume (and, hence, trading fees) on the token is the primary demand driver for the $SUSHI token, due to how the token accrues value from the protocol.

Naturally, a question arises about whether this is an efficient model and whether buying back the $SUSHI token in this instance and then distributing it to $SUSHI stakers is “optimal” or at least a win for $SUSHI stakers and the protocol.

Let’s examine.

Consequences for the protocol:

The protocol revenue could have been used for something else (example, acquiring long-term treasury assets, incentivizing further liquidity provision, R&D, etc.)—this is effectively an opportunity cost.

The protocol incentivizes participating in governance since a prerequisite to participating in governance is staking $SUSHI, and by distributing yield to stakers, it incentivizes partaking in governance. Furthermore, by buying back $SUSHI tokens (creating buy pressure), it may incentivize others to do the same, subsequently directing them towards staking them tokens (this is more of a psyop).

Following the logic from the previous point (creating buy pressure for the $SUSHI token and incentivizing staking), the protocol is able to uphold the price of the $SUSHI token, whose core tenet (at least one of them) is incentivizing liquidity provision, as the $SUSHI token is emitted to liquidity pools (for the rationale behind this, I encourage you to have a look at one of my other posts on this below). This means that a higher $SUSHI price>more emissions for liquidity pools>more liquidity deposited—highly beneficial to the protocol, as we have understood.

The protocol is distributing $SUSHI to the stakeholder ($SUSHI stakers) most unlikely to sell these tokens. This is because, arguably, the stakeholder with the most vested interest (incentive alignment) with the protocol is $SUSHI stakers (I mean they obviously want to see the protocol succeed due to aforementioned links between the protocol and token), so they are less likely to dump the $SUSHI they receive as yield because their underlying position is denominated in $SUSHI, meaning that they are already “bullish,” for the lack of a better word, and it makes them less likely than say a liquidity provider with no incentives aligned (between them and the protocol) to sell the $SUSHI tokens they receive.

Since most of the liquidity for $SUSHI resides on SushiSwap itself, any buybacks of $SUSHI mean that the value leakage (swap fees) goes to liquidity providers on the platform, further incentivizing liquidity for $SUSHI pools and also subsidizing more $SUSHI buybacks since a portion of this swap fee goes back into buying $SUSHI tokens.

Consequences for the $SUSHI staker:

The staker’s underlying $SUSHI position appreciated due to the buyback of $SUSHI done by the protocol.

The staker is receiving a constant stream of yield denominated in $SUSHI (i.e., passive income or perpetual revenue); however, if the staker doesn’t like the fact that they’re earning this yield in $SUSHI tokens, they can always sell them on the open market; in the worst-case scenario, some of the value is leaked through swap fees (and MEV) and in the time that the staker takes to sell the $SUSHI tokens, it might have depreciated (as $SUSHI can be trading at “x” when the staker receives the yield but “x-1” when he’s selling it, representing some yield forgone). The latter issue can be resolved by using an autocompounder, but they don’t exist for all pools and also represent added value leakage as they charge a fee. Essentially, the staker can “realize” this yield (denominated in $SUSHI) by trading it for another token like $ETH or $wBTC, but some value is lost either to swap fees or to autocompounder fees.

Either way, the price of $SUSHI can never be lower than what it was when the protocol first bought it, ceteris paribus, due to swap fees (and also due to price impact due to low liquidity — this is explored further below), as when I’m trading $SUSHI for $ETH, let’s say, I won’t be able to sell 100% of my $SUSHI as some of that $SUSHI will be taken as a swap fee and given to liquidity providers.However, obviously, any one staker selling their token, especially if a significant sum, can make panic ensue in the market wherein selling>panic>more selling, but that would be true in any case (not just with $SUSHI stakers receiving $SUSHI), hence why I said ceteris paribus.

But, like with anything in life, there are nuances to this model.

More specifically, it’s limitations, which we’ll go over:

If there’s not enough liquidity for the token (in this case, $SUSHI), but the protocol still carries out routine buybacks without being aware of the depth of liquidity pools (which, in this case, is shallow), then a lot—and I mean a lot—of value can be lost due to price impact (read this to understand price impact and price slippage—they are not the same). While this will benefit the holders of $SUSHI (as a high price impact to the upside = price increase), it can devalue the yield stakers are receiving, increasing the opportunity cost for the protocol and taking away from the value accrued to the stakers, as they are receiving tokens (the yield) that the protocol bought for a much higher price (value leakage) and are also not able to cash out this yield (i.e., realize it) due to the same problem, i.e., constraint with a lack of liquidity! Essentially, if the token being bought back and distributed doesn’t have enough on-chain liquidity to facilitate buy and sell orders without moving the market significantly (high price impact), a model like this is a recipe for value leakage to the max.

When price impact (due to low liquidity) is introduced, even more value can be leaked (more specifically, extracted) by MEV bots through sandwich attacks. However, when there is high liquidity and hence individual trades move the market less (low price impact), the amount of value leaked to these MEV bots isn’t substantial.

In the example above with $xSUSHI, the value leakage through swap fees is, to some extent, recaptured by the protocol, but if the token being bought back and distributed isn’t the native token of a DEX (like in this example $SUSHI being bought back and distributed on its own DEX, SushiSwap), hardly any of this value can be recaptured, but a lot of those swap fees will stream to providers of liquidity for that said token’s pool, incentivizing liquidity provision for it in the future, which might negate the aforementioned consequences of value leakage in the paragraph above.

A model like this constrains user choice, as the token being distributed to them is “forced” onto them, and the only way out of it is to realize this yield by selling it for something else, which, as we mentioned, incurs swap fees and even MEV (as a bot holding said token can sell the token before the user does so and then buy it back after, resulting in worse execution for the user)—both forms of value leakage from the POV of the users. Furthermore, users who don’t want yield to accumulate in said token can always use an autocompounder, but they’re not always available for that pool, and if they are, they charge more fees (which leads to more value leakage), and this is making the assumption that the said token won't crash in value, which can result in some of the yield being sold after the crash. Basically, even when using an autocompounder, price fluctuations in said token can affect the realized yield for the user. And in a scenario without an autocompounder, this concern is amplified. Also, either with using an autocompounder or selling the said tokens manually for a token the user wants, gas fees are incurred constantly (more value leakage), which wouldn’t be the case if yield accrued in a “blue-chip” asset like $ETH, which is “relatively” stable and desirable to accumulate in most cases.

So, where does that leave us?

First of all, you now know the merits and drawbacks of such a model. And hopefully, you also know whether a model like this might work for your project or not, and if it would, which token to buyback and distribute to token holders (whether it be the native token or something like $ETH).

But to summarize, it really depends on the exact model being implemented, liquidity for the project token, and other factors such as whether autocompounders exist and how much value leakage (and recapture) is happening, the project’s token stability, etc.

Some implementations of this model (that buyback their own, i.e., native token) that make sense and I like are $xSUSHI, as mentioned above, and $veFXS (which used to do this but will pause such a model for sometime following FIP-188), but both of these examples use their native DEX to carry out the token buybacks, which minimize the value leakage that comes with such a model (due to the aforementioned value recapture process).

Overall, I’d say that the more mature a project is (the more liquidity it has), the more “rightful inclination” it can have to buyback and distribute it’s own token.

I hope you learned something, and if you need any help ideating your tokenomics or just want to discuss anything crypto or football related, just reach out to me on Telegram @imajinl (t.me/imajinl)!

Until next time,

Imajinl