The new iteration of non-custodial portfolio management

A deep dive into the current composability landscape in DeFi and an introduction to harnessing the composability of DeFi with programmable.fi

I’ve been a DeFi zealot and avid yield farmer for almost 2 years now.

It’s honestly the wild west out here in DeFi.

Every day there’s some new rug pull or protocol getting hacked or rugged, and every month there’s some black swan event resulting in cascading liquidations (many of which, unfortunately, I fell prey to and got some of my positions wiped out; I learned a lot about leverage from these experiences).

Even really big, battle-tested protocols have gotten hacked recently (in 2023) like Yearn, Curve (for a whopping $62 million), and Balancer—all OG DeFi protocols.

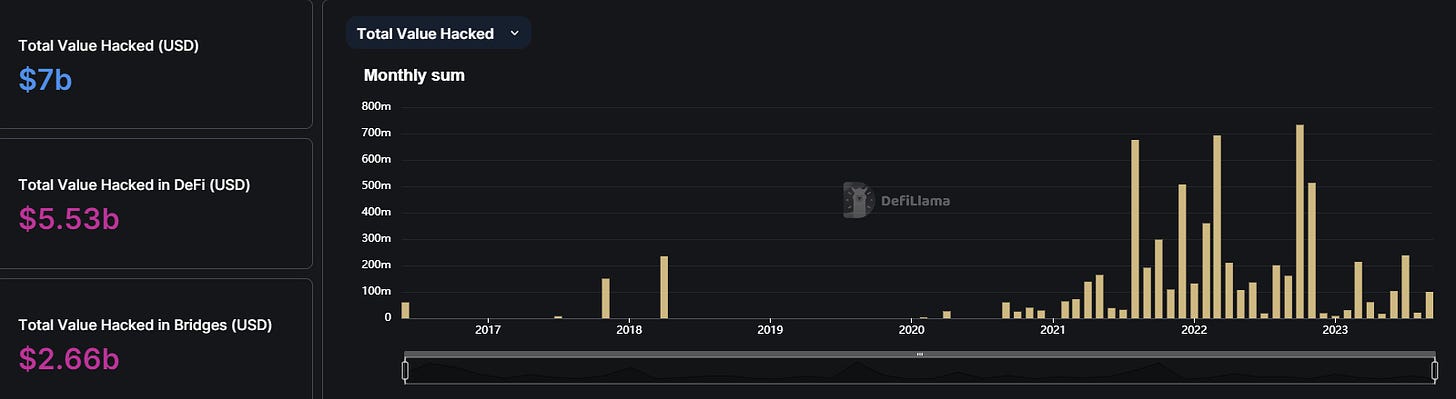

This chart from DeFiLlama encapsulates the degree of risk associated with DeFi.

But the thing is, DeFi is still a very nascent technology.

Finance in Web 1.0 and Web 2.0 (TradFi, or the legacy financial system, as it's called in the industry) experienced its fair share of "hacks" and security challenges too.

But the key distinction between DeFi and TradFi is the fact that DeFi runs on the blockchain, an immutable and decentralized ledger, which stands in stark contrast to TradFi, which is mutable and relatively centralized.

Fraudulent transaction in your bank account? Unauthorized spending from your credit or debit cards? Just call the bank up, and they’ll sort it out for you.

TradFi essentially has a cushion to fall back on (for example, if there are hacks) due to its mutability and relatively centralized nature.

Unfortunately, that luxury is not present in DeFi. Lost your private key(s)? You’re screwed. Mess with the wrong smart contracts? You’re screwed. There’s basically no one to call when there’s a mishap—such is the inherent characteristic of an immutable blockchain like Ethereum. Once it's on-chain (on the blockchain), it’s set in stone (with a few exceptions, of course).

But is it really so unfortunate? Or is it the price you need to pay to be a truly self-sovereign individual, free of any oppressive government control?

Well, that’s for you to decide—I have digressed enough.

I will, however, leave you with a quote from Andreas Antonopoulos, a legend in the Bitcoin community, to which you can connect what I said.

“For the 'other 6 billion' who don't enjoy international, control-free banking as we do, bitcoin represents an opportunity to become part of a global economy which up till now did not exist. For those users, bitcoin is more than just a curiosity, it might be a doorway to connect to the world.” ~Andreas Antonopoulos

So where am I going with this?

The point that I’m getting at is that the same way we have fewer hacks in Web 2.0 now than we did in the mid-2000s, DeFi will have fewer hacks in the future.

Right now, DeFi is going through a lot of trial and error, and it will come out stronger on the other side, primed for adoption, especially institutional adoption.

Think of these hacks as a means of getting DeFi prepared to revolutionize finance, something I’m sure most of you reading believe DeFi is capable of.

If you’re not convinced, I highly recommend listening to or reading (I personally used Audible) all three volumes of the Internet of Money series by Andreas Antonopoulos—probably the best books about Bitcoin and blockchains ever made.

Ok, ok—enough about hacks and enough hyperbole.

I now want to pivot and share with you one aspect of DeFi that is either overlooked or often misunderstood but is an instrumental aspect of what makes DeFi so great.

It’s something degenerates like me crave, but it's also something capable of putting DeFi on the map.

Composability.

Maybe you’re familiar with this concept in the traditional world.

“Composability exists in many forms in the traditional world. When you use PayPal to pay for an Uber, or when you sign into the Airbnb app with your Facebook login, you are leveraging the composability of each application.” ~Monolith

But in the traditional world, financial composability is not ubiquitous.

Imagine being able to instantly and permissionlessly borrow against securities (long-tail ones too) and commodities, provide liquidity (become market makers to earn fees) for stocks you hold, and automatically move your money around different commercial papers to find the best yield.

These are all things that are either quite hard, impossible, or unaccessible to most people in TradFi. You’ll get laughed out of the room for even suggesting anything remotely close to that.

That’s where DeFi comes in with smart contracts.

Smart contracts are the key to unlocking composability in DeFi.

They’re the reason I can take a loan out denominated in U.S. dollar stablecoins (essentially U.S. dollars on the blockchain) against my crypto, lend these stablecoins (provide liquidity for them) out on a DEX, or deposit my stablecoins into a yield aggregating protocol to earn the best yield in DeFi (for that stablecoin).

The possibilities are endless, but it goes to show how much is possible when leveraging composability in DeFi.

For an in-depth explanation of all the types of composability in DeFi, I recommend reading this article by MoonPay and this article by Monolith, as well as watching the video below to further conceptualize the concept with more applications.

The TL;DR is basically that DeFi composability is like money legos (something I hinted at in the image above). You attach one lego in the way you want to the other in order to build the things you want.

And that’s something I want to help people with.

To harness the composability of DeFi, I set out to build a protocol that’s centered around non-custodial portfolio management, which I am (for now at least) calling programmable.fi.

I’ve been thinking about such a protocol for months now and am now starting to build it out.

In the rest of the post, I aim to outline what the protocol will aim to do initially and the desirable end goal.

But before I go any further, I just wanted to say that if you’re short on time and understand yield aggregators/autocompounders very well, feel free to skip to the “The core product” section.

The current landscape:

Ethereum—we all know about it, and a lot of us invest in and believe in its future.

Well, I’m no exception—a good chunk of my portfolio is invested in $ETH (Ethereum’s native token).

But I didn’t stop there. I wanted to grow my $ETH position—without buying more, though.

That’s where these DeFi legos (composability) come into play.

They let me earn a yield on my $ETH, so I could grow my $ETH position by stacking more tokens.

One example of the way I’m earning on my $ETH tokens is by providing liquidity for them (watch the video below if you don’t know what that is).

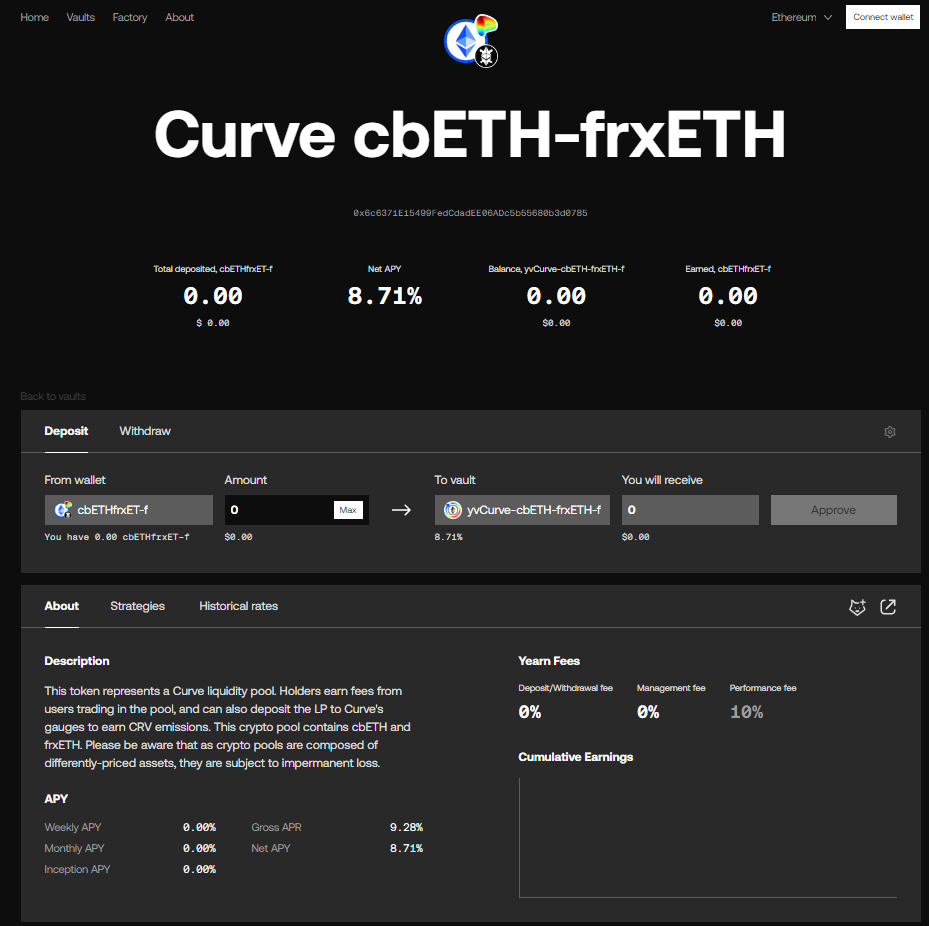

If you follow DeFi, you might know about Curve, the second largest decentralized crypto exchange (DEX) by TVL (total value locked).

It’s mostly used on Ethereum, but it's also used on a lot of other blockchains.

Since DEXs don’t have orderbooks, they use AMMs, which require liquidity pools to function (see the video above if this is unclear).

This is where liquidity providers like myself (think of us as small market makers) come in.

By providing liquidity on Curve, I’m earning trading fees but also additional rewards, called pool2 emissions, which come in the form of $CRV tokens (Curve’s native token) from the Curve gauge.

In my instance, I’m providing liquidity for the cbETH/frxETH liquidity pool (LP) on the Ethereum blockchain, and because Curve wants more liquidity on their platform than incumbents like Uniswap, they give people like me extra $CRV tokens as rewards on top of trading fees to deposit liquidity on Curve.

But the problem for me is that I want more $ETH tokens, not more $CRV tokens, as I think $ETH has more upside potential.

So in my scenario, I’m earning a handsome yield in $CRV (trading fees too, but let’s not think about that for now). I’m earning that yield in a token that I don’t want exposure to (I want to neutralize my delta for it).

So what I could do every once in a while is sell the $CRV tokens for more LP tokens (cbETH/frxETH in this example), but the problem is that this is expensive since blockspace on Ethereum is expensive, i.e., gas fees are high.

And since I might not have much time on my hands, I’d maybe only do this approximately every 2 months. So in the meantime, I would have exposure to the $CRV tokens’ price (I don't neutralize my delta for it) instead of $ETH or some other token I think has more upside.

I would also not be fully leveraging the power of compounding, since I could have compounded my interest more frequently than every 2 months, but due to gas fees and time constraints, this is just not feasible.

But what if there was a protocol that compounded these $CRV tokens into more cbETH/frxETH LP tokens automatically, i.e., every day?

Well, this is akin to the autocompounder or yield aggregator (I’ll just call it an autocompounder throughout my writing for now) protocol we see prevalently in DeFi that you use to neutralize the delta (minimize exposure) to the token you're receiving the yield in, as well as have your position compounded for you very regularly, gas efficiently (this is explained later on), and automatically (without you needing to do anything).

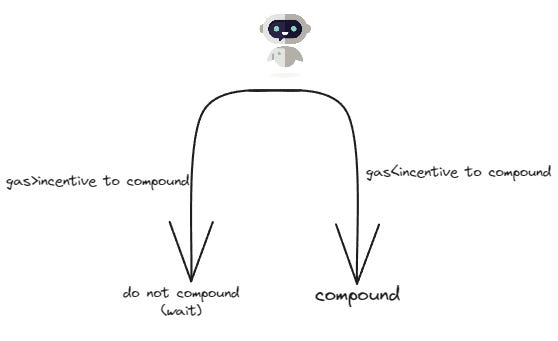

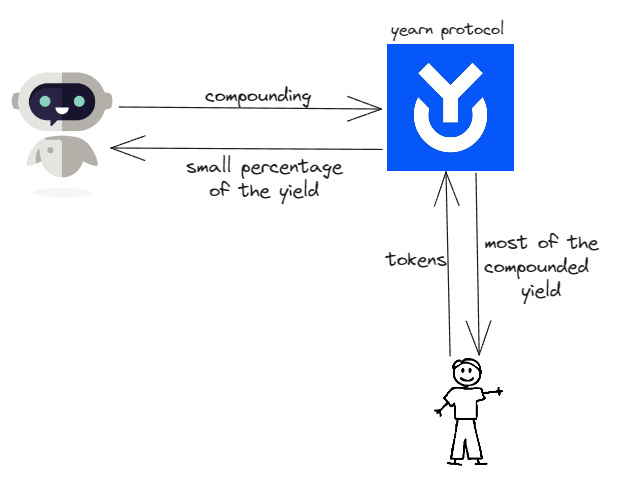

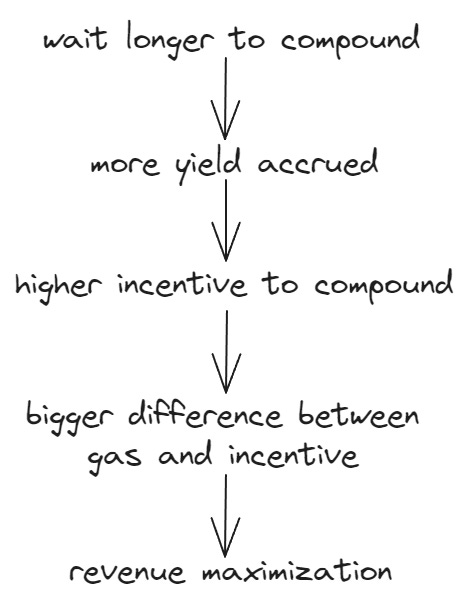

To “autocompound” your positions, these protocols, such as Yearn, the most commonly used protocol for autocompounding and yield aggregation, often rely on “bots,” basically just smart contracts programmed to compound your position when the incentive is right.

As seen above, when the gas to compound (that the bot pays) is more than the incentive, compounding doesn’t happen, and when the gas to compound (that the bot pays) is less than the incentive, compounding happens, ceteris paribus.

This incentive is usually a percentage of the yield accrued (that’s about to be compounded), but never the principal amount, i.e., the tokens the user put in to be compounded.

Usually, when competition is high between bots to compound, the process of compounding happens more frequently (but at the same cost), and when the competition between bots to compound is low, compounding happens less frequently (but still happens, and there is still an incentive to do so, even more of an incentive if the incentive scales up while gas costs are at the same levels).

On blockchains and DAGs (think L2s like Arbitrum, Optimism, and Base and DAGs like Fantom and Avalanche) with very low transaction costs (gas), compounding happens a few times every minute (on average), but on blockchains like Ethereum that have high transaction costs (gas), compounding happens much less frequently (usually once a day, but it really depends).

Now let's segue to efficiency as it relates to different compounding frequencies.

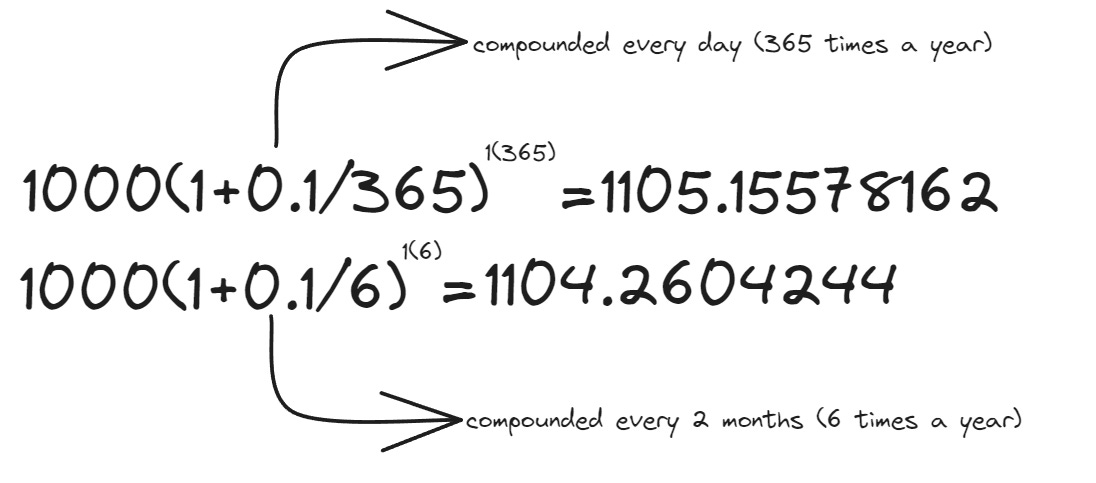

Let’s see the difference mathematically between compounding daily vs. every 2 months—it's easy math, I swear.

In the example above, where I’m compounding $1000 at 10% annual interest/yield, compounding 365 times a year (every day) vs. compounding every 2 months (6 times a year) yielded little result.

A mere 0.0811% difference in yield (to 3 significant figures) between compounding every day vs. every 2 months

At this point, you may be questioning the existence of an autocompounder, since the difference between such daily compounding (using an autocompounder) and sporadic/infrequent (usually manual) compounding is so minimal.

But this math doesn’t paint the whole picture—far from it, actually.

This is because it doesn’t take into consideration these pivotal facts and considerations.

Using an autocompounder removes the need for human intervention (you don’t need to spend time on compounding), so there is no longer an opportunity cost of your time when you are signing a few transactions.

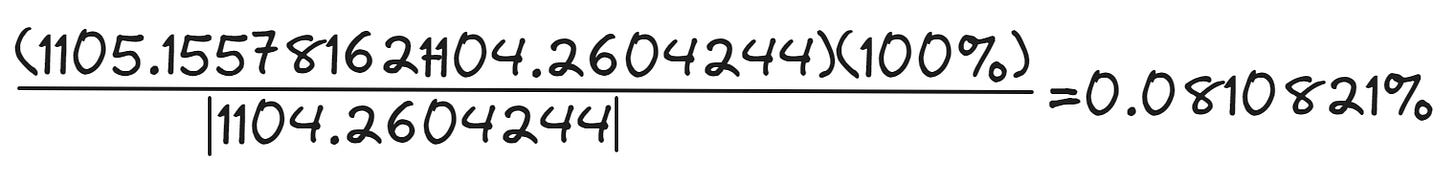

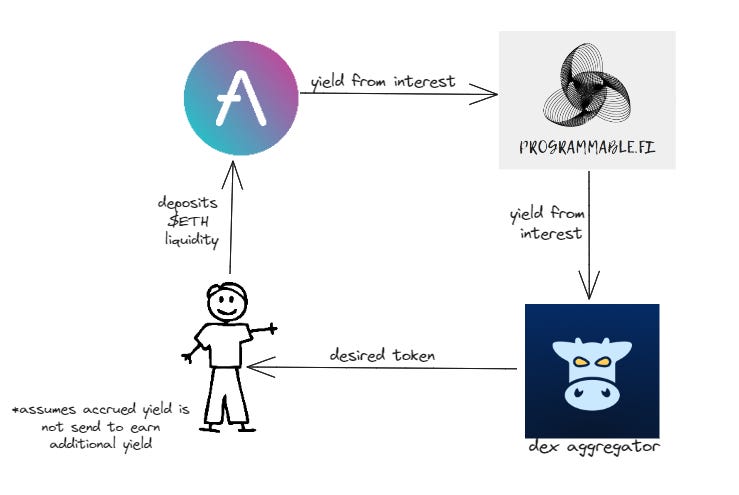

Let’s say you are lending your $ETH tokens out on a money market (lending and borrowing market) like Aave so that other users can borrow them (think of this as a bank deposit but for your $ETH tokens).

On top of the interest you earn that is paid by the borrower(s) of your $ETH tokens (which reflects in your $ETH token balance/deposit on Aave going up as you accrue interest), $AAVE might incentivize (they do not now, but they used to) deposits of $ETH tokens, so you’d earn some $AAVE tokens on top of the interest, so in order to compound these $AAVE tokens, you’d have to claim them (1 transaction), approve a DEX like Curve to spend these tokens (2 transactions), swap these tokens for $ETH (3 transactions), and then deposit them back into Aave (4 transactions) in order to finish the compound.

So you’re signing four transactions, interacting with two protocols (Curve and Aave in this example), and waiting in the meantime for each transaction to go through (which will take some time if you’re transacting on a blockchain like Ethereum).

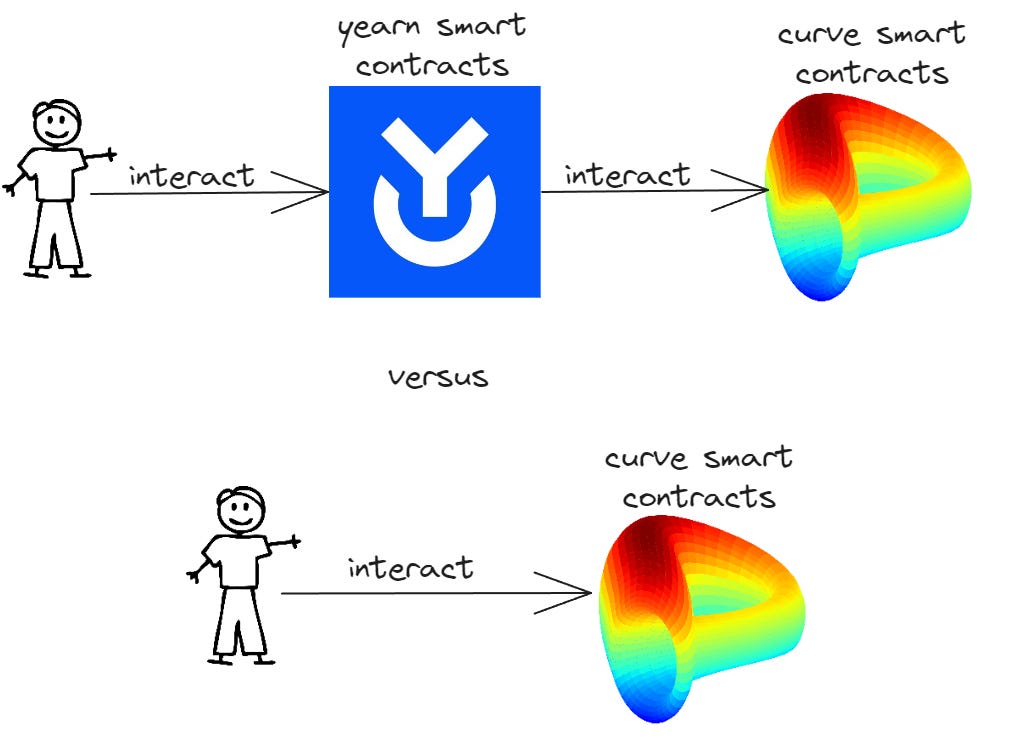

This process can be visualized in the image below.

It’s just not a very seamless process, to be honest. It’s clear to see why someone would like to outsource all this to an autocompounder.

As mentioned above, you’re signing four transactions. This is relatively gas intensive (it costs significant money to do the compound, especially if you’re doing it on Ethereum), but you save a lot of money (gas) if you use an autocompounder. You can take my word for it and skip to the next point, but I’ll outline the two main reasons below for those interested.

i) Since you’re not the only depositor in the protocol (the autocompounder), the gas costs are spread out. What I mean is that if there are many depositors and the cumulative yield accrued by these depositors is $1000, while the incentive fee is 2.5% of the yield (as you recall from above, the incentive for a bot to compound is a percentage of this accrued yield), and the gas costs associated with compounding the position are $20, doing the math you deduce that the bot nets $5, but you, on the other hand, no matter what your share of the cumulative deposits (and subsequently accrued yield was) were, save on gas costs (in DeFi, the amount you’re transacting with doesn’t have any affect on the gas costs, i.e., if you were compounding $10 or $1000, the gas costs would still be $20 in this scenario).So, essentially, these autocompounders achieve economies of scale, so as long as you’re not the only depositor, you save on gas costs (the more depositors there are, the less gas you bear as an individual depositor, i.e., higher economies of scale are at play).

This is a confusing idea to wrap your head around, so don’t worry if you didn’t get it—you can also refer here for another explanation of the above.

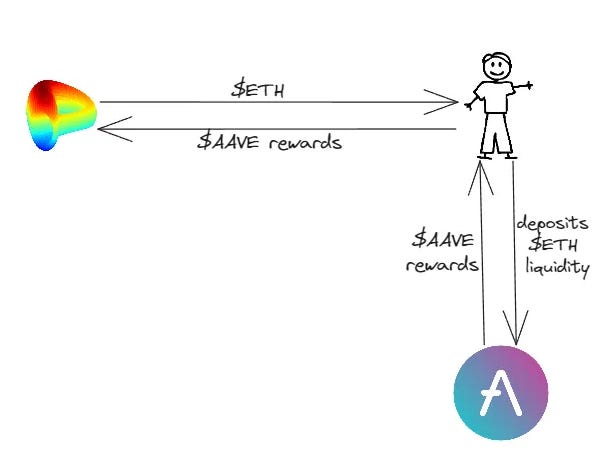

ii) Another factor affecting the magnitude of gas costs you save when using an autocompounder is the profit-maximizing characteristics of these bots (I outlined their functions and operations above, if you recall).The fact is that these bots, as long as they’re rational, try to maximize the difference (spread) between the incentive they’re receiving (to compound) and the gas costs they will need to incur to compound the position (in order to maximize their revenue).

Part of this is waiting for gas to drop (which happens when the blockchain is less congested, i.e., less economic activity is happening on the blockchain).So the bot is effectively initiating the compound when gas on the blockchain is lowest, something you individually (if you manually manage the compounding) would not do unless you’re this guy.

But then, as seen in the image below, wouldn’t the bot take forever to compound the position (since the longer it waits to compound, the more revenue it generates)?

Well, the short answer is no.

This comes down to the competition between bots (that has been explained above), which makes it so that if a bot waits too long to compound, another bot comes in and takes away the revenue (by compounding the position).

Oh man, I love free markets and competition.

So by outsourcing the compounding, you, as a user, get the maximum efficiency in terms of gas savings without losing out on compounding frequency.By compounding so frequently, you’re effectively delta-neutral (having no exposure) to the token you’re compounding. And if it’s a token you’re willingly selling to compound your position, the chances are that you don’t think it has very good upside potential, or worse yet, think that it has downside exposure.

By extension, you now have a positive delta (have exposure) to the token you’re compounding into (following the same logic as above, if it’s a token you’re willingly compounding into, the chances are that you don’t think it has a lot of downside potential, but you think it has upside potential, i.e., you think it has asymmetric upside potential), so you’re maximizing your bets and potentially your return.

The last factor is MEV (miner/maximal extractable value) protection and other optimizations.

When you’re using an autocompounder such as Yearn, you are usually protected from MEV and are getting the best trade execution.While I won’t talk about MEV in depth here since there are plenty of good resources out there like the video above, MEV as it relates to autocompounders usually works like this.

For example, you’re selling $wBTC tokens to compound your $ETH position (buy more $ETH and deposit it) on Aave.But before you buy your $ETH tokens, someone (usually a bot) incentivizes (basically by paying more gas fees) a miner (if you’re using a blockchain with PoW consensus) or validator (if you’re using a blockchain with PoS consensus) to put their transaction, which is a buy order for $ETH in front of yours (so their transaction that pushes the price of $ETH up before you buy $ETH occurs first, giving you worse execution for your buy order of $ETH), and then a sell order for $ETH right after your transaction to buy $ETH goes through.

This is a very prevalent form of MEV in DeFi, and it goes by the name of sandwich attacks.

Yikes, nasty, right?

You’re getting a worse execution (buy price) for $ETH, and then right after you buy it, it’s worth less.

I wouldn’t want that.

That’s why many DeFi users (including Yearn) route their orders through this thing called a private mempool.

As I said, I won’t delve into how this all works (the video above does a great job at explaining this), but think of using a private message as a way to avoid getting sandwich attacked.

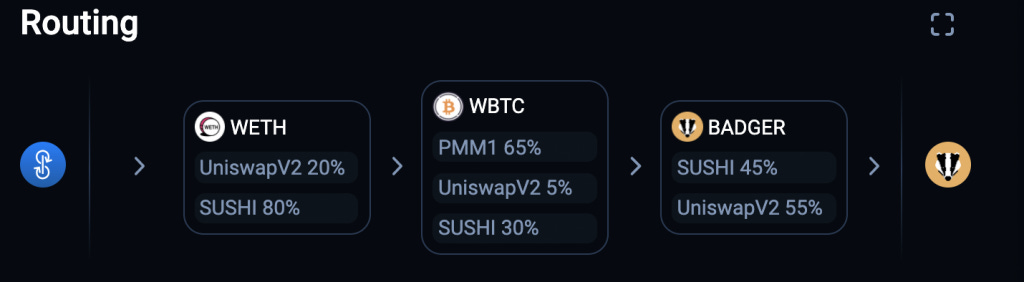

On top of using a private mempool to save you money, autocompounders like Yearn also use DEX aggregators like 1inch and CoW Swap (my personal favorite) to get you the best execution on your trades (when compounding, which involves selling one token and buying another).They basically work by splitting your trade between many DEXs to get the best execution (prices), as seen above.

The thing is, you could do both (use a private mempool and a DEX aggregator) on your own, but as elucidated in the first point made (about saving time), outsourcing all this just makes the most sense.

Congratulations! You now officially understand why autocompounders make a lot of sense to use.

But before we move on, I want you to remember that all these advantages autocompounders offer obviously come at a few costs. The first one is smart contract risk. Since by using an autocompounder you’re essentially trusting your funds with the code of a few smart contracts rather than one (as seen in the above below), using an autocompounder introduces another layer of risk.

Also, these autocompounders charge a fee (usually a percentage of the yield accrued—usually a negligible amount, which I’m sure you’ll agree is fair for the service they’re providing).

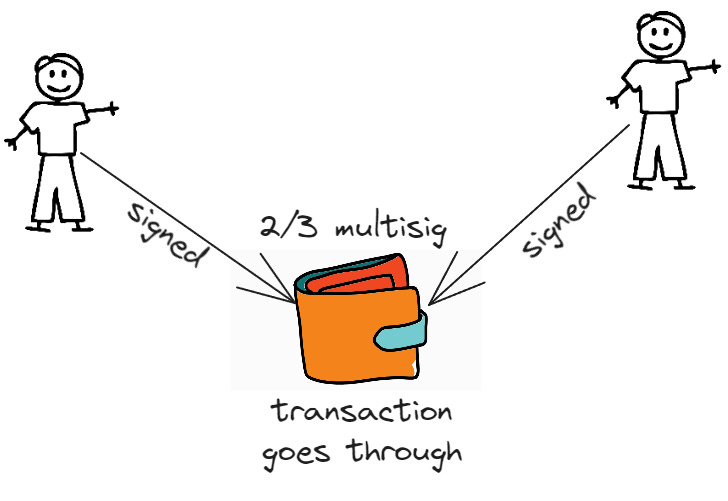

Another risk that is prevalent in these kinds of protocols is a rug pull by the multisignature wallet.

Some autocompounders, like Beefy Finance, use a popular protocol deployed on multiple blockchains; more specifically, the contracts are “controlled” by a multisignature wallet (multisig); there are some nuances when I say controlled, hence the air quotes, but the core idea stays as is.

These wallets are managed by a group of people, or, in the case of protocols like Beefy Finance, by the team.

As seen in the image below, transactions only go through if a predefined number of people managing the wallet (signers) sign off on the transaction.

If you want to understand the concept of a multisignature wallet better, I recommend watching the video below.

But the point is that these smart contracts being “controlled” by the multisignature are subject to the mercy of their signers (in this case, the team).

While the chances of such a rug pull happening (especially by a large protocol like Beefy) in such a manner are low (it’s not really in the best interests of the team), it is still a possibility if the signers find their keys vulnerable or the team is served with a court order—just remember that crazier stuff has happened in DeFi.

Another post that I’ll put out soon delves into the details of how such a rug pull can happen, and just overall goes into more technical details about risk vectors that arise from the centralization of protocols through a multi-signature and the various nuances that you need to know about.

Nice work! You now thoroughly understand the current landscape, workings, advantages, and drawbacks of yield aggregating and autocompounding protocols.

But there’s one hurdle with the current landscape—a huge one.

In all the examples I stated (like the autocompounding of $AAVE rewards into more $ETH lent out and the autocompounding of $AERO rewards into more cbETH/frxETH LP tokens), you could only autocompound accrued yield into more of the “principal” token, i.e., the token(s) on which you are currently earning a yield.

This is simply the way it works in DeFi today: you can either autocompound yield into more LP tokens or have access to autocompounding strategies (like the one with Aave), or at the very least, more complicated strategies like the one with Aave but further optimized for yield (think of the same strategies but the protocol depositing your $ETH tokens to be lent out on the money market yielding the highest interest rates and additional rewards/yield).

So there’s essentially no way in DeFi currently to earn passive income the way you want it, due to the aforementioned caveat.

Using the previous example of autocompounding $AAVE rewards into more $ETH tokens lent out, what if the only reason I didn’t neutralize my delta for $ETH (have no exposure to it) was because I found this interest rate (to lend my $ETH out) on top of the $AAVE rewards (yield) attractive enough for me to have positive delta (exposure) to a token I didn’t want (in this case $ETH)?

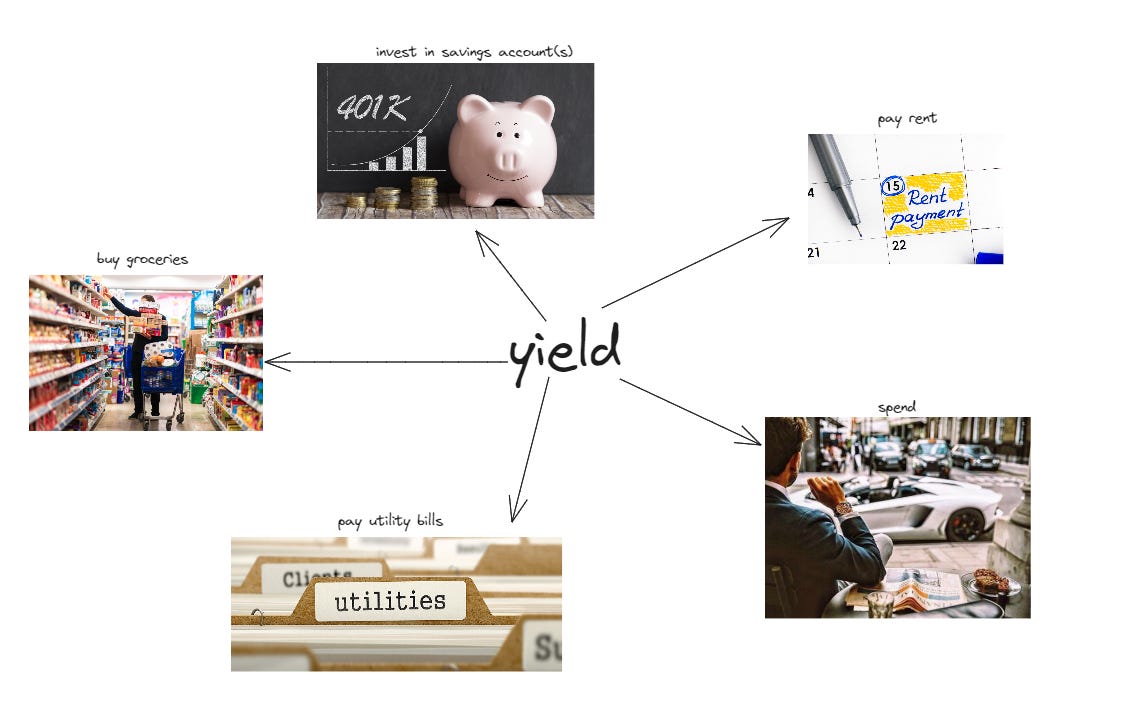

Then wouldn’t I want to realize profits from my $AAVE rewards (yield) to build up a position that I actually wanted and then earn a compounded yield on that? Or, what if I wanted to earn the yield solely denominated in stablecoins and then offramp them and contribute to a 401k, buy my groceries, pay my rent or utility bills, or just spend it? (In this instance, you wouldn’t be compounding rewards or earning an additional layer of yield, but you can't save everything in crypto now, can you?)

Of course I would want to do something like that (or at least have access to such a product)!

But, as I said, nothing like this exists in the current DeFi landscape.

And now you finally understand the need for a protocol like programmable.fi!

So to summarize really simply, autocompounders make sense to use because:

1) You save a ton of time.

2) You’re saving a lot of money since you pay less for gas costs.

3) You’re neutralizing your delta (having no exposure) to the token in which you’re earning the yield and getting a positive delta (having exposure) to the token you want to earn the yield in.

4) You’re protected from MEV and get the best trade execution.

But autocompounders:

1) Are usually centralized.

2) Charge fees by taking a percentage of the yield earned.

And most importantly, autocompounders do not let users earn the yield in the token(s) they want, which is where programmable.fi comes in (the protocol is explained in depth below).

The core product:

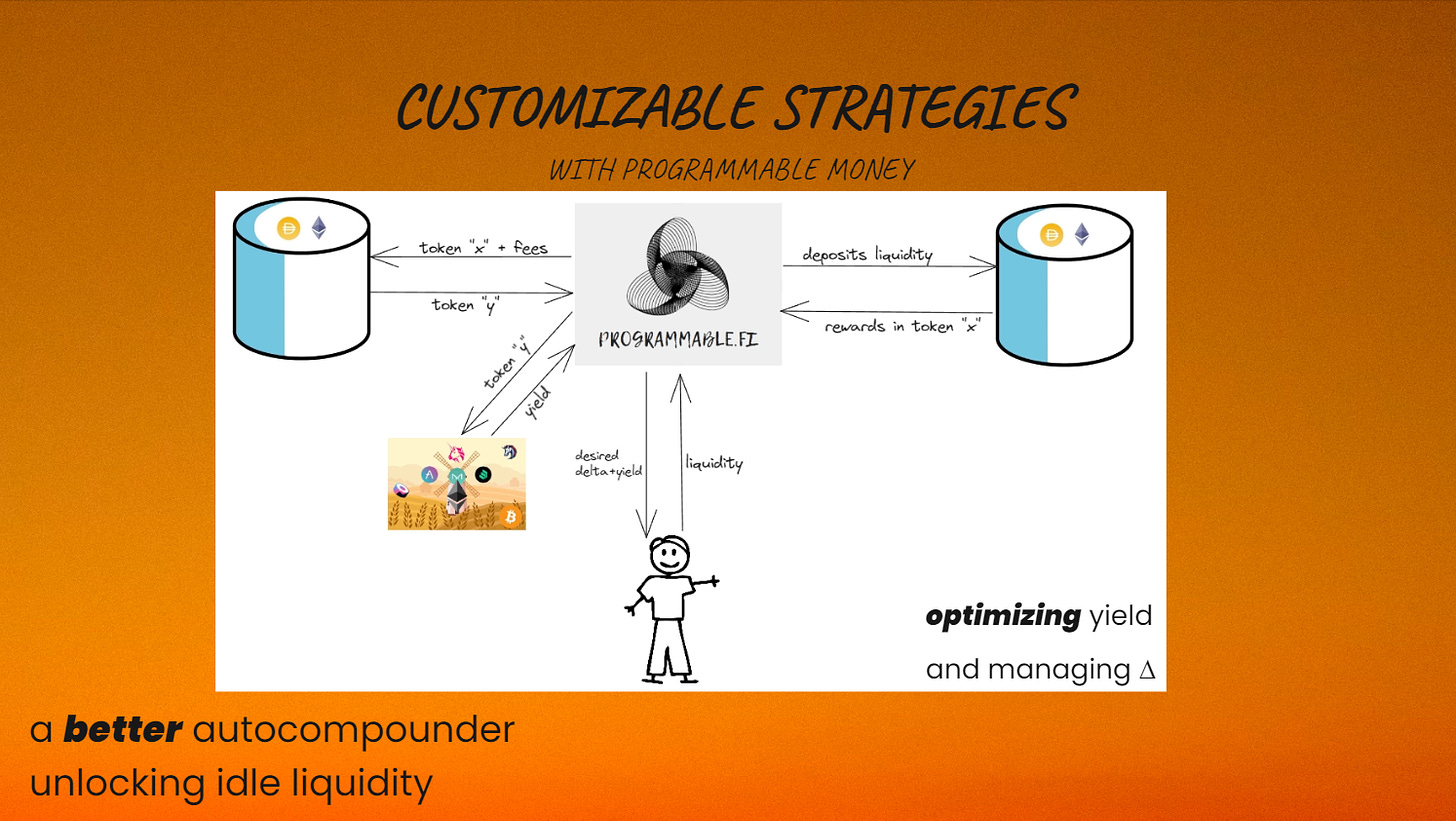

By now, you probably understand the need for such a product, but allow me to explain it visually and in a simpler manner.

The core product is simply allowing you (the user) to earn a yield (passive income) the way you want it.

Below, we will take a look at some examples.

Let’s say you like to provide liquidity for the ETH/DAI pair on Sushi, which is an OG DEX on Ethereum and other blockchains.

By providing liquidity, you’re earning trading fees (which reflect the inherent position value in token denominations going up) and $SUSHI tokens (Sushi’s native token) as additional rewards (why DEXs do this has been previously explained).

But let’s assume you’re not the biggest fan of the $SUSHI token, and you do not want more exposure to the ETH/DAI pair since you value portfolio diversification.

So if you value the advantages of an autocompounder (which have been previously described) and want to use one without needing to accumulate more (autocompound) ETH/DAI position (the only option in DeFi currently for this instance), you’d take your LP tokens to programmable.fi and specify which token you want to earn your yield in, and optionally even specify where you want to earn a yield on the token you’re earning a yield in (for example, if you want to convert the $SUSHI yield into a yield in $USDT, and then lend these $USDT tokens out on Aave, and then any additional yield, for example through $AAVE emissions if any, have compounded back into $USDT).

Furthermore, maybe you want the $SUSHI tokens to just be sold for $USDC and accumulate in your wallet, so that every once in a while you offramp these $USDC tokens and pay for your rent, mortgage, groceries, dinner, really whatever.

With programmable.fi, the sky is really the limit with what strategies you want to create and the way you want to earn your yield (passive income) and manage your portfolio.

Secondary products:

Apart from the core functionality of the protocol, which is explained above, the protocol would ideally have some secondary products, which I’ll explain here.

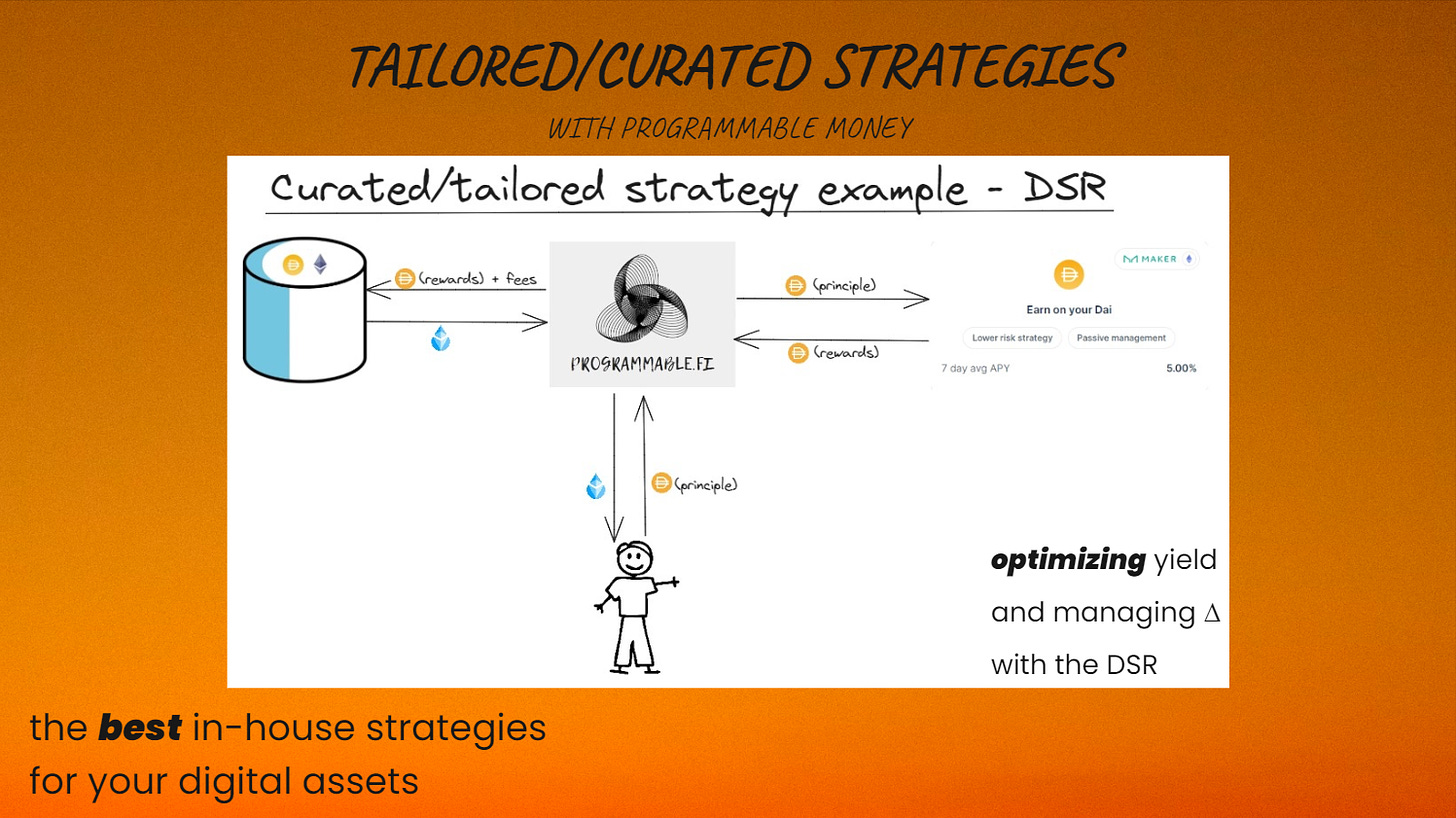

One secondary product that made sense to me when I was ideating the core product was tailored or curated strategies.

The thing about a novel protocol like programmable.fi is that people might not know what to do with it from the outset, and they might require some inspiration or strategies shown to them to demonstrate what is possible and how you might utilize a protocol like this.

So there would be some strategies curated or tailored by the team that would be displayed on the front page and would be super simple to deposit into (without needing to make strategies of your own).

These strategies would be something that the team would anticipate would have high demand—some of which I’ll elucidate below.

One idea that I had was a strategy built around the DSR ($DAI savings rate).

I won’t talk about the DSR too much here, but it’s basically a smart contract developed by MakerDAO (the issuer of the $DAI stablecoin) that allows $DAI holders to deposit their $DAI tokens into the contract and earn a 5-8% APY, which comes from some of the revenue generated by the MakerDAO protocol instead of from non-sustainable sources (like a secondary token reward that all the examples given so far were based around—for why such a yield is unsustainable, I recommend reading this article).

To learn more about the DSR and how it works, I recommend reading the FAQ here.

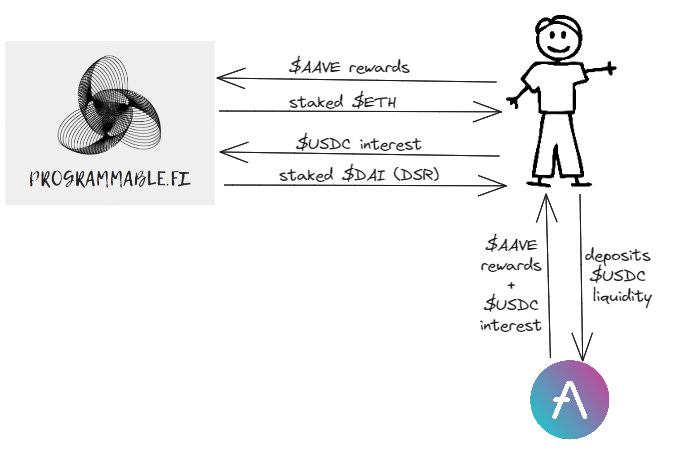

But the strategy around it basically works like this:

The protocol (programmable.fi) accepts deposits of $DAI (principle amount), and any $DAI rewards (yield) on top of the principle amount of $DAI are sold for $stETH (Lido staked ETH, which is an LSD for $ETH on the Beacon chain—read this if you’re confused about all this jargon), so you’re essentially stacking (accumulating) $ETH tokens from the $DAI yield, and then on top of that, you’re earning an additional compounded yield on $ETH as you’re indirectly staking it (through holding $stETH).

It’s important to note that with the strategy above, there are many nuances associated with creating it, but the core idea still remains; it’s just that I’m presenting it in a simplified manner.

After thinking about such a strategy, I realized another crucial use case with programmable.fi was possible!

Until now, with all the examples of yield compounding and aggregating I have given you, the tokens compounded or aggregated were always the native tokens of the protocol, which were rewarded or emitted to encourage usage of the said protocol (example, AAVE rewarding lenders with $AAVE tokens, Curve rewarding liquidity providers with $CRV, etc.), but as I said above, this might not be the most sustainable in the long run (for example, when the supply of these tokens available to reward caps off or runs out), so then what use would a protocol like programmable.fi be?

Well, therein lies another potential strategy that solely deals with real yields (links for understanding this concept have been provided above)!

Even if these additional token rewards (for example, $AAVE) given to users were stopped, AAVE could facilitate the generation of yield for users through the lending interest rates paid by borrowers.

But as we talked about previously, autocompounders in DeFi currently don’t do anything about this since this interest rate accrued is reflected through more tokens lent out (for example, if you lend $ETH to Aave and accrue interest, you won’t claim the interest rate accrued; it will just reflect through a larger position denominated in $ETH that you’re lending out), which is the whole purpose of autocompounders, i.e., you’re earning this yield in more of the same token (being lent out), and this is what autocompounders facilitate in the first place, so there’s nothing for them (the autocompounders) to do! And for the user, there’s no way to earn this interest rate (while harnessing the power of autocompounders) in the token they want!

And once again, that’s where programmable.fi comes in.

Another functionality of programmable.fi would be to separate the principal deposit of tokens (into, let’s say, a protocol like Aave) from the yield (interest rate accrued) denominated in that same token, and then let the user customize the strategy associated with the yield (interest rate accrued).

For example, if you lend out 1 $ETH token on Aave, you accrue yield through the lending interest rate, which will reflect through your $ETH lending position growing in $ETH terms. So anything on top of the principal $ETH token deposit would be reinvested into a position you actually want and then additionally (optionally) earn a yield (that may or may not be a compounded one).

Strategies like the one above with Aave and the one with the DSR (as well as all the strategies already explained that have additional yield attached to them) make sense for a few reasons that haven’t been covered yet.

Two of these are:

These are self-explanatory, but that doesn’t discount the importance of such a use case.

Let’s take an example of a DAO (decentralized autonomous organization) that has a treasury with stablecoins in it (let’s say $DAI for now) and wants to invest in the future of Ethereum by buying $ETH.

However, by buying $ETH, the $DAI in the treasury is depleted, and contributors to the DAO cannot be compensated for their contributions.

In an instance like this, a perfect solution would be to use a protocol like programmable.fi, where the DAO can earn a yield on their $DAI holdings and automatically invest into $ETH (or even staked $ETH) without the risk of not being able to compensate contributors but still accumulate $ETH.

This is great because $ETH is bought over a period of time, almost like a dollar cost average strategy, so it positions the DAO in a favorable position for when a bull market is upon crypto.

Further, these treasuries for DAOs are placed under the control of a multisig (this concept has been covered above), so coordinating between multisig signers (DAO contributors) every time to buy $ETH would be cumbersome for obvious reasons, and outsourcing this to a protocol like programmable.fi makes the most sense.

With programmable.fi, DAOs can automatically convert the dollar cost average into crypto with the yield accrued from their stablecoin reserves, giving contributors to the DAO time to work on things that matter.

To conclude this section, let me mention something important.

We looked at strategies dealing with additional (unsustainable) rewards, as we called them, and also real yield.

But these are not strategies that are mutually exclusive.

I envision the protocol being able to facilitate strategies that deal both with the real yield and the additional rewards or yield.

For example, the strategy below, where $USDC is deposited into the AAVE protocol, accrues $USDC interest and $AAVE rewards, which are sold into $DAI and $ETH, respectively, and are staked in to earn an additional yield.

I keep saying this, but only because I really mean it — on programmable.fi, the sky is really the limit with what strategies you want to create and the way you want to earn your yield (passive income) and manage your portfolio.

The end goal:

Honestly, with programmable.fi, the end goal would be to make it as composable as possible—this means support for any strategy and token, as well as support for super complex strategies.

Essentially, programmable.fi would be a protocol where DAOs, other protocols, and retail and institutional investors come to assemble all the money Legos the fascinating world of DeFi has to offer.

Down the line, I also envision an expansion into strategies built around real-world assets; this would be ideal as this is a huge use case of DeFi I’m extremely bullish on, and infrastructure and support for them are being laid as we speak with protocols like MakerDAO (which has been talked about at length already above), Frax Finance, and these other protocols.

One thing that comes to mind off the top of my head is recurring bank deposits through accrued yield.

Imagine you use programmable.fi to earn yield, and at the end of each month or something, programmable.fi converts all accrued yield to a stablecoin like $USDT or $USDC that’s redeemable for real U.S. dollars and sends them to your bank account.

It’s probably not revolutionary or anything, but I could see demand for such a service.

Wrapping up:

Finally, you made it to the end of this super, super long post.

To be fair, I could have tried to condense all this information, but it is what it is.

If you’re building something similar, want to give me any feedback, ask me any questions, or want to be an early tester of the protocol when it’s out, I would love for you to reach out to me using any of the means below (Telegram preferred).

Twitter: @imajinl

Email: imajinl@tokenomicsdao.com

Telegram: https://t.me/imajinl

Discord: imajinl

No, seriously, hearing from you would be awesome.

That’s it for now, though. Expect some related and unrelated posts (to programmable.fi) to be written soon; subscribe using the button below so you don’t miss out!

Until next time,

Imajinl

Great article as always imajin! Keep it up.