monetizing prediction markets

understanding the trading and attention economics of polymarket 💸

I’ve been thinking a bit lately about how Polymarket (and Kalshi, etc.) is going to go about monetizing their prediction market business. There are two angles to this — the trading side and the information / attention side. On the trading side, they can monetize deposits and flows.

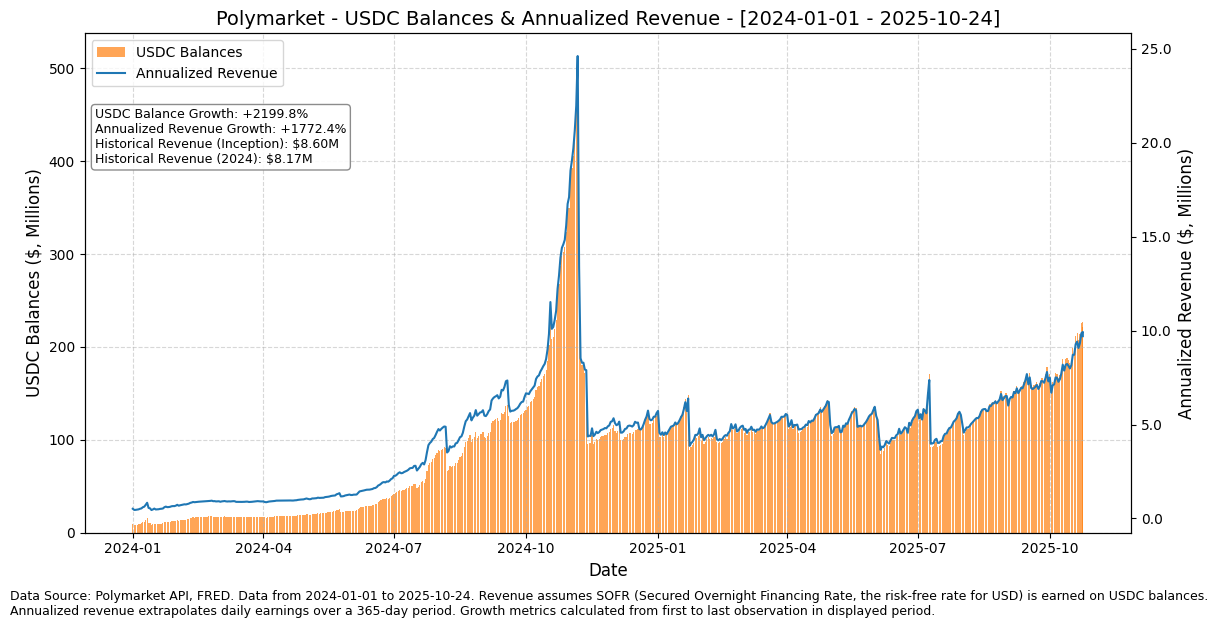

Deposits: This refers to any USDC balance held on Polymarket (it can be an idle balance or USDC used to place a limit order). Given the underlying USDC is backed mainly by Treasury Bills, it generates a ‘risk-free yield,’ currently ~4.2%. So you can imagine a world where Polymarket strikes a deal with Circle to share some of the yield that USDC on Polymarket is generating. Or, even better, Polymarket can re-denominate all USDC balances on the platform in their own native stablecoin (if they launch one), basically owning all the economics of their stablecoins and not being beholden to Circle (this would basically entail converting / redeeming all user balances from USDC to their own dollar-pegged stablecoin and sticking the underlying dollars into a yielding, short-term instrument like Treasury Bills). What would this — capturing the yield of the stablecoins on their platform — have looked like for Polymarket if they did this from the beginning? As seen below, assuming Polymarket captured 100% of the yield USDC on their platform generated, they would have only made ~$8.6M (~$8.17M of that being from the start of 2024). This assumes the USDC was earning, give-or-take, the prevailing SOFR (secured overnight financing rate — basically the risk-free rate for U.S. dollars). Even with their current USDC balances sitting at north of $200M, they can really only generate a theoretical maximum of <$10M (but you’d have to factor in revenue share with Circle, and if they issued their own stablecoin, the fixed costs and ongoing variable costs, needing to have non-yielding reserves for redemption, etc.). And with the Fed embarking on a rate-cutting cycle, this is clearly not a viable way to monetize a prediction market like Polymarket at scale.

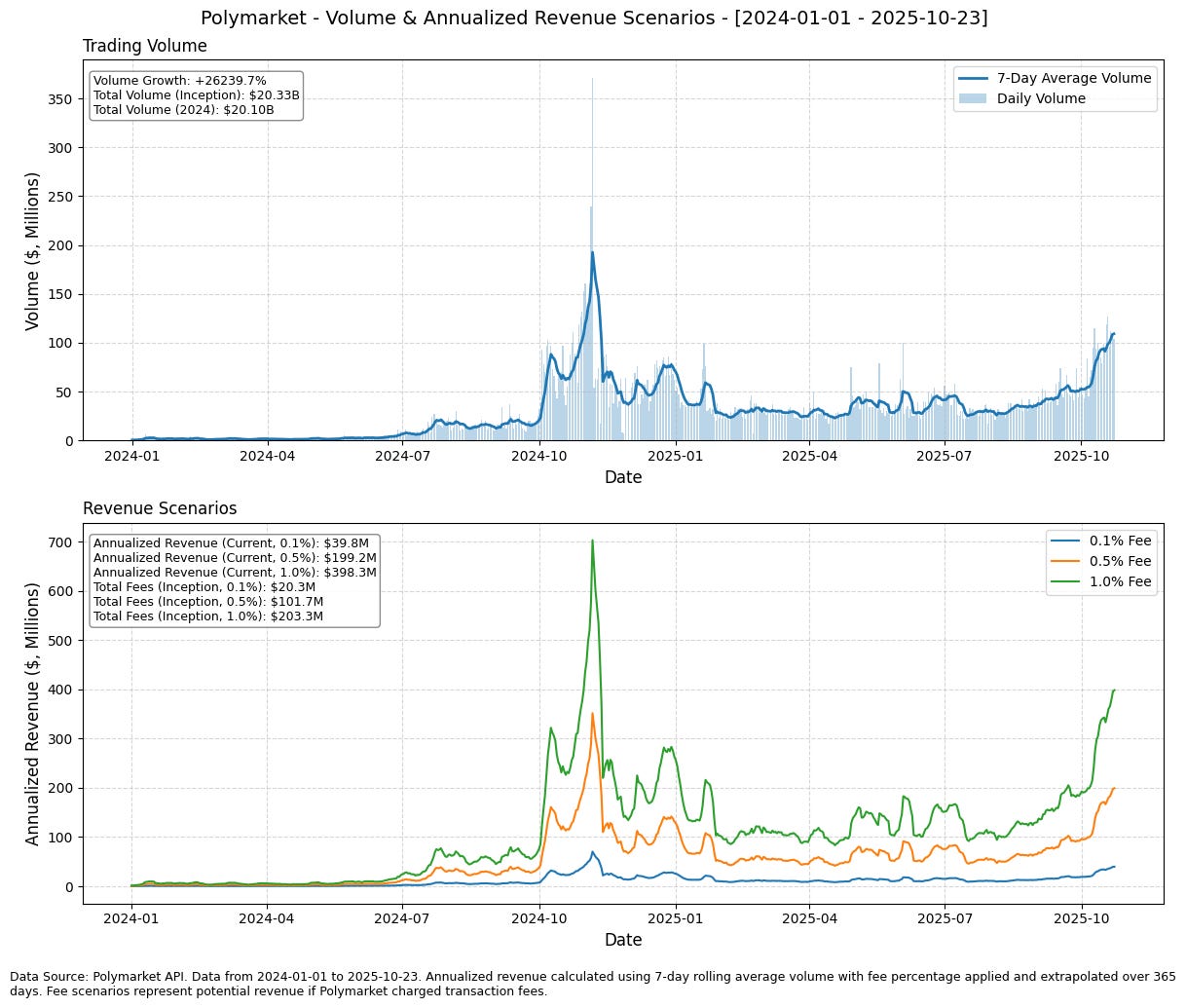

Flows: This refers to trade activity conducted on Polymarket. When a buyer / seller with a patient disposition interacts with a seller / buyer with an impatient disposition, a trade is consummated. In other words, when makers of liquidity place limit orders on Polymarket’s orderbooks and takers of liquidity come in and execute against that liquidity, trade volume materializes. What if Polymarket took a fee on trade volume, say 1%? So if a patient seller (the maker) sold $100 worth of some YES / NO event share to an aggressive buyer (the taker), the seller would receive $100 minus X (the maker fee), and the buyer would pay $100 plus Y (the taker fee) to receive the YES / NO shares. Like with most orderbooks that incentivize maker activity (as they create liquidity for markets), let’s assume the maker fee is much lower than the taker fee — say a 0.1% to 0.9% split. So 0.9% of the fee for each trade would be paid by the taker, and 0.1% by the maker, and this would all go to Polymarket for providing the marketplace for the parties to trade. Polymarket doesn’t charge any fees on trading now, but what if they did? As seen below, Polymarket generated, since inception, ~$20.33 billion of volume (~$20.10B of that since the start of 2024). Accordingly, using a 7-day rolling average volume with a fee percentage applied and extrapolated over 365 days, we can plot, under different fee scenarios, what annualized revenue would look like — under a 1bps fee scenario, 50bps fee scenario, and a 100bps fee scenario. And as seen, at the current 7-day rolling average volume, Polymarket would annualize ~$400M in revenue at a 100bps fee scenario. At 50bps, that would be ~$200M, and at 10bps, ~$40M.

Pretty solid! Not to mention that the volume Polymarket is seeing now is a fraction of what it could be. To put it into context, DraftKings — the largest sports book in the U.S. — reported a volume of ~$48B in 2024! This is just sports volume from a U.S. audience! Add a global audience through crypto distribution and any world event (economic, political, or social), and it would be pretty feasible for Polymarket to be generating hundreds of billions of dollars in trading volume. Assuming a $300B trading volume at a 0.5% trading fee, Polymarket would generate a whopping $1.5B in top-line revenue — to put it into perspective, DraftKings keeps about ~9% to ~10% of the betting volume as revenue!

But are we missing the forest for the trees?

As alluded to at the start, there’s also the information / attention side to the business. After all, Polymarket is a ‘betting’ platform for traders, but an information / news platform for everyone else! Traders price information into the markets, and this is distilled down into market-implied odds of different events for consumers of information — your voters, businesses, bystanders, etc. Said differently, every world event will get eyeballs onto prediction markets. It won’t be a substitute for media organizations, reporters, etc., but it will induce a paradigm shift in how news is delivered — media outlets, pundits, etc. anchoring their commentary to actual markets that have capital at risk on getting the correct answer (unlike in current mainstream media, where the predominant way to make money isn’t by being right, but by telling people what they want to hear, not what’s actually happening, or worse yet, by pushing a hidden agenda).

So what is this side of the business worth? In short, if every world event gets eyeballs onto Polymarket, it’s clear that the potential monetization of trading fees / USDC balances becomes secondary or even tertiary line items for Polymarket.

Let’s put some numbers on this: If Polymarket scales to billions of views annually — say 5-10 billion pageviews, comparable to major media properties like CNN or ESPN — the monetization potential becomes staggering, potentially eclipsing even the most optimistic trading fee (and yield on USDC balances) scenarios. Premium publishers regularly command $20-50 CPMs (which is the cost per thousand impressions) on engaged audiences, and what’s a better audience than Polymarket visitors during moments of peak information demand (elections, economic decisions, geopolitical crises)? With billions of pageviews and premium CPMs of $50-100+ during peak events, you’re looking at $250M to $1B+ in advertising revenue annually — rivaling or exceeding traditional media giants, but with far lower content production costs since the ‘content’ (market odds) is generated by traders, not expensive newsrooms!

But the real prize is positioning Polymarket as essential infrastructure for truth in the digital age (specifically a digital age where trust in institutions — governments, legacy media, etc. — is at an all-time low). Every major news organization, financial terminal, search engine, and AI assistant will want to surface Polymarket odds as the canonical source of probabilistic truth about future events. Imagine Google Search displaying Polymarket odds for contested questions, ChatGPT / Claude citing prediction markets as ground truth, or governance systems built on prediction markets. License fees, API revenue, and data partnerships at that level of ubiquity could easily generate another $500M-$1B+ annually — think Bloomberg Terminal pricing power ($24,000-$27,000 / seat) but for real-time collective / crowdsourced intelligence on literally everything happening in the world.

The ultimate bull case is if Polymarket doesn’t just compete with DraftKings or betting platforms and actually becomes the epistemological backbone of the internet, the go-to oracle for “what’s actually going to happen or is currently happening” on everything from elections to IPOs to Oscar winners.

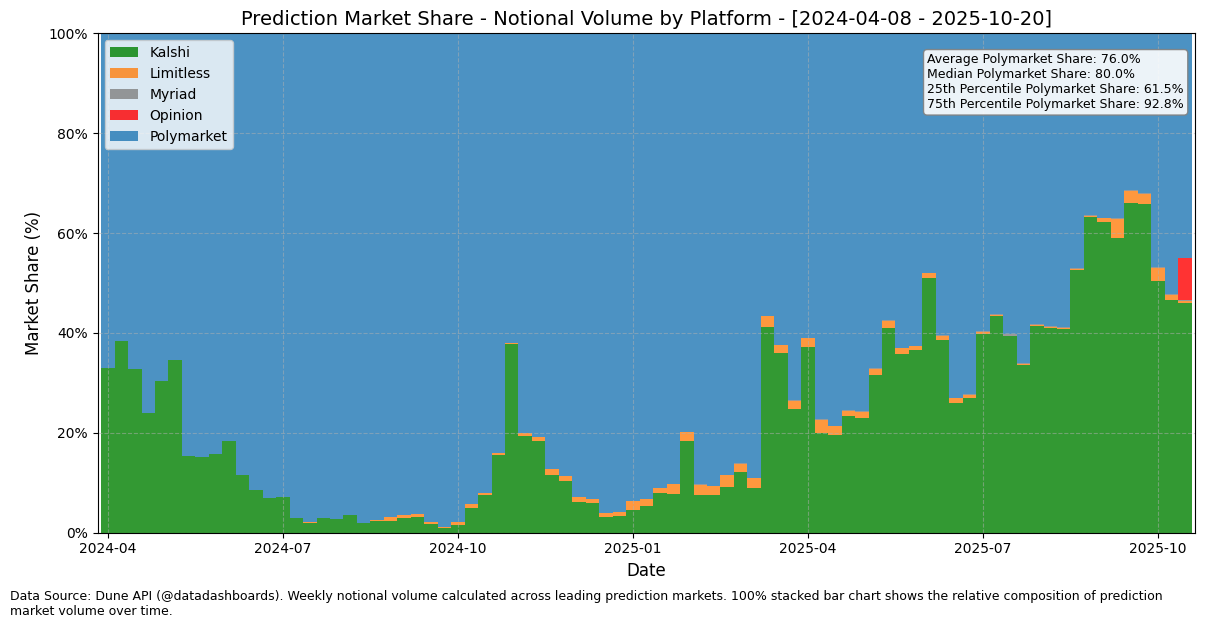

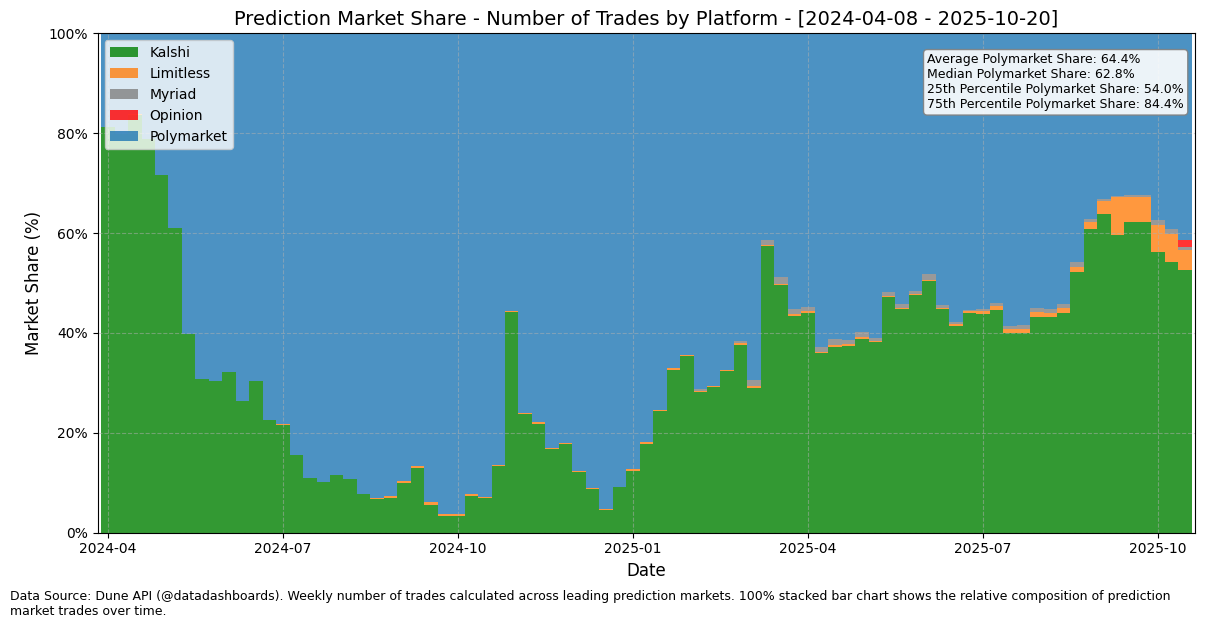

Granted, it’s not a foregone conclusion that Polymarket will be the dominant prediction market platform. While it currently dominates both (i) notional trading volume on prediction markets and (ii) the number of bets / trades placed on prediction markets (as seen above), it may be the case that a novel upstart like Limitless starts to capture more volume on long-tail markets. Or maybe, Kalshi becomes the clearinghouse (basically the backend orderbook where trades are routed to) for not only Robinhood but other legacy financial institutions before Polymarket can, and given it’s a network-effects business, users and liquidity matter more than anything else. One thing is for certain — marketplaces for almost everything are power law distributed — a few winners will take most of the market share. And if prediction markets become as big as I think they will (and many others think they will), a large share of an even larger pie is generational wealth creation.

My bet’s on Polymarket. See you in the orderbooks.

great post!